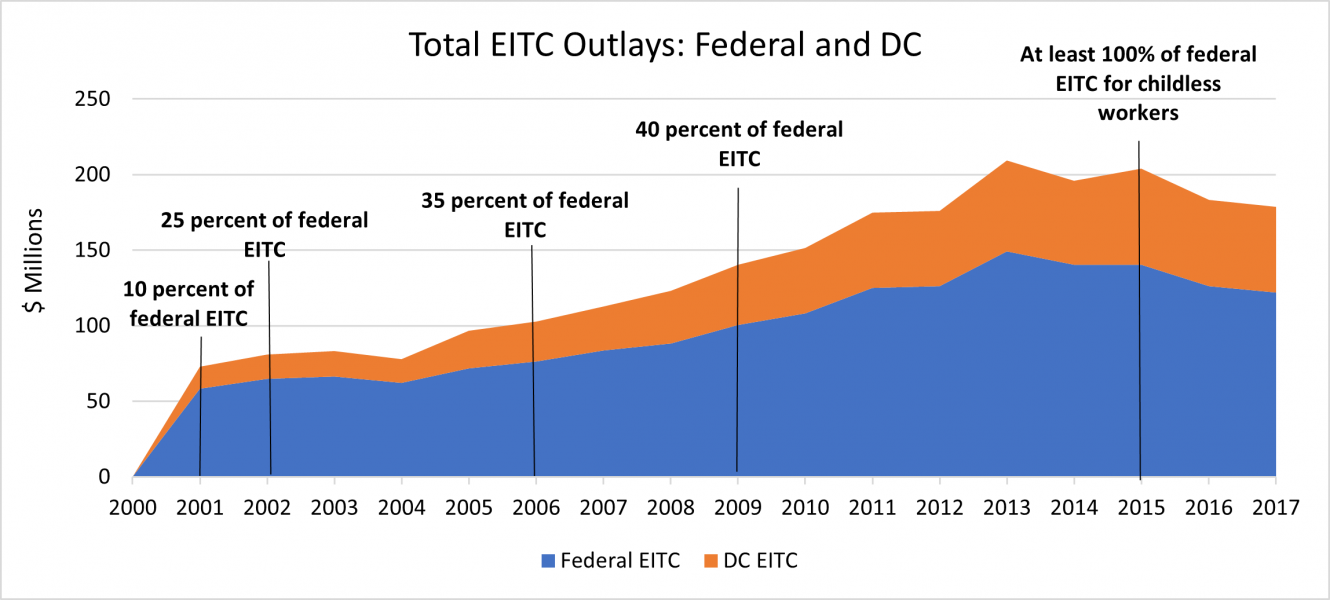

The DC Earned Income Tax Credit (DC EITC) was created as an add-on to the federal earned income tax credit to encourage work, reduce poverty, and provide additional tax relief to low-income taxpayers, especially those with dependent children in the District. In TY 2017, 62,513 Washingtonians claimed about $57 million in earned income tax credits in addition to $122 million in federal EITC. ORA recently released a detailed analysis of the DC EITC in our “Review of Income Security and Social Policy Tax Expenditures” Review of Income Security and Social Policy Tax Expenditures 2021 | ora-cfo (dc.gov). The following is the first of a series of DC EITC blog posts that summarizes the descriptive analysis provided in that report.

Chart 1: Total Federal and DC EITC by Year with DC EITC Effective Amendment Dates

Source: ORA. Note: The data labels refer to the years the DC EITC changes became effective

To claim the EITC, tax filers must meet the eligibility requirements instituted by the federal government. The most recent 2020 federal eligibility requirements were as follows:

- Investment income received must be $3,650 or less for the year, and a federal adjusted gross income of less than:

- $15,820 ($21,710 married filing jointly) with zero qualifying children

- $41,756 ($467,646 married filing jointly) with one qualifying child

- $47,440 ($53,330 married filing jointly) with two qualifying children

- $50,594 ($56,844 married filing jointly) with three or more qualifying children

- Maximum federal credit amounts:

- $538 with no qualifying children

- $3,584 with one qualifying child

- $5,920 with two qualifying children

- $6,660 with three or more qualifying children

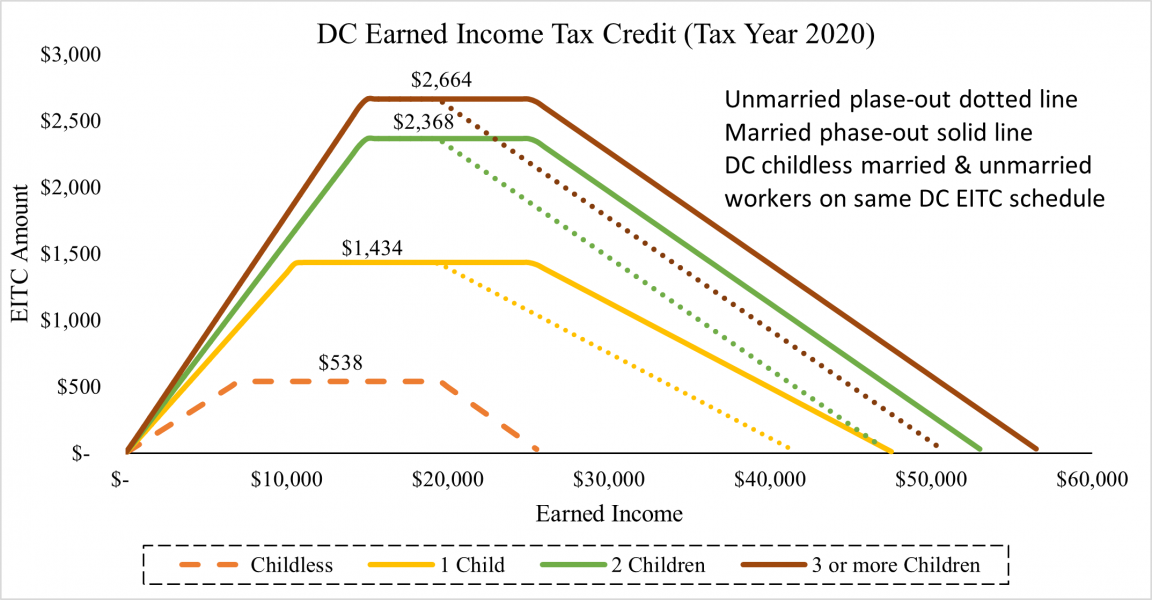

If qualified, the tax filer can claim 40 percent of the federal credit for families with qualifying children. In 2014, DC expanded the EITC childless workers to be at least 100 percent of the federal credit and a wider earned income range (chart 2). The expansion allows more tax filers to receive more of the credit. For example, in tax year 2020, the federal EITC began its phasing out for single childless workers with income at about $8,800 ($14,700 for married filing jointly) and ran out at income over $15,820 ($21,710 for married filing jointly). However, the DC EITC allows filers to claim the full federal credit (not just 40%) and extends the income to get the maximum credit from $8,800 for single childless workers ($14,700 for married filing jointly) to $19,489 for both groups and phases out until it runs out when income reaches $25,833 for both married and unmarried tax filers (dashed line in chart 2).

Chart 2: DC EITC Schedule, 2020

Based on our review of administrative tax data, between 2010 and 2017, on average 60,141 filers claimed $952 in benefits each year, with the majority earning incomes between $10,000 to $25,000 per year, shown in Table 1. This illustrates the broad impact of the program despite strict eligibility limits that target low-income families.

Source: OCFO/OTR

By design, the DC EITC has helped reduce poverty in the District and in 2017 about 10 percent of households with children and an estimated 3.9 percent of childless workers claiming the credit were elevated out of poverty: 1,874 filers (with 3,386 children) and 489 childless adults. Our Review shows the DC EITC is meeting the goal set by the DC Council of reducing tax burdens for low-income workers when the legislation was enacted and has lowered the average tax and effective tax rates for its claimants compared to tax filers with the same income and reference income level not claiming the credit.

Our analysis also highlights some areas where the credit could be improved. To obtain better results and improve accountability, ORA finds that the DC EITC could be amended in a variety of ways including addressing the marriage penalty that exists for childless workers, going after tax preparers for fraudulent returns, providing more resources for outreach and supporting the Office of Tax and Revenue’s (OTR) efforts to reduce fraud. Please see our complete analysis for further detail.

What is this data?

This study used DC individual income and federal individual income administrative tax data from 2001 to 2017. This data is geocoded and provides information on DC EITC claimants including amount claimed, and number of qualified dependents.