Below is the letter our office sent to the Mayor and DC Council, outlining our December 2024 revenue estimate. Read the full letter with data appendices here. Read the PowerPoint overview here.

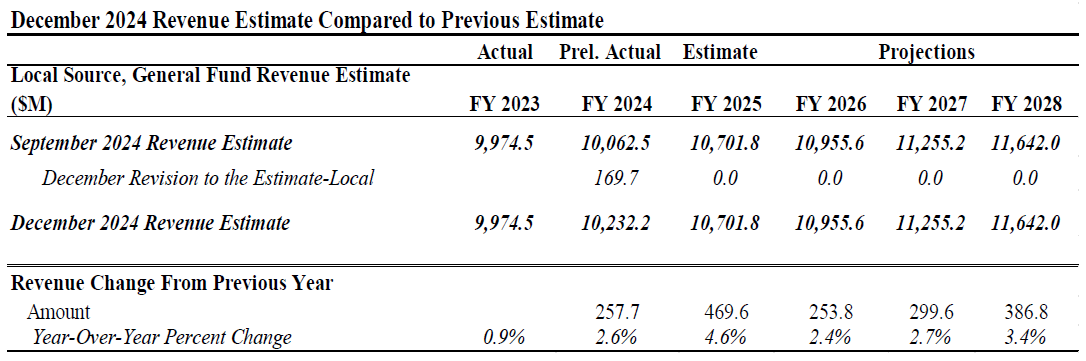

This letter certifies that the revenue estimate for the FY 2025 – FY 2028 District of Columbia Budget and Financial Plan is unchanged from the September 2024 forecast. However, preliminary actuals for FY 2024 show that revenue was $169.7 million higher than the September forecast. The largest share of the higher revenue is from one-time litigation proceeds and year-end accounting adjustments related to prior-year cost recoveries. Higher collection rates for real property taxes and higher-than-expected withholding and corporation tax payments largely account for the remainder. Note that additional year-end accounting adjustments may occur as the revenue total for FY 2024 is not considered final until the Annual Comprehensive Financial Report (ACFR) is released.

As noted above, preliminary revenue data for FY 2024 shows that revenue was higher than the September forecast. However, approximately 46 percent of the higher revenue is non-recurring and will not affect long-term projections. An additional 33 percent of the increased revenue is due to higher-than-expected property tax receipts related to Tax Year 2024 and prior-year assessments. The implications of this stronger-than-expected property tax revenue performance for future years cannot be determined until new property tax assessments are released in early 2025. Approximately 13 percent of the revenue increase is from withholding tax payments, which benefited from higher wages despite a decline in resident employment in certain sectors. While rising resident wages are a positive sign for the District's economy, recent downward revisions to resident employment levels raise concerns and could limit future individual income tax revenue growth. The remainder of the revenue increase originates from volatile sources, such as corporation franchise payments.

The District's economic outlook is effectively unchanged from the previous forecast. While national economic growth was strong in the third quarter of 2024, there is growing consensus that growth will slow in 2025. On the positive side, the U.S. Census Bureau recently released updated population data for the District that shows an increase of 14,926 new residents, a growth of 2.2 percent over 2023 levels. Net international migration accounts for the bulk of the increase. While this growth exceeds the population projections included in the September revenue estimate, the impact on revenue is already captured in the FY 2024 revenue performance.

Uncertainties loom for the District following the U.S. election. Proposals to relocate federal workers or reduce their number could significantly impact the District's economy, where federal civilian employment accounts for nearly 25 percent of jobs and 28 percent of wages. On the other hand, initiatives aimed at encouraging federal employees to return to in-office work could provide a much-needed boost to local restaurants, retail businesses, and WMATA revenues. It could also limit or even reverse the trend of increasing the office vacancy rates in the District. Additionally, policies such as increased tariffs and restrictions on international migration present additional uncertainties for the national and local economies. Given the economic uncertainties and the fact that the stronger-than-expected revenue performance of FY 2024 was due either to one-time sources or to revenue sources with highly uncertain future performance, we have not changed the revenue projections for FY 2025-2028.

We will continue to monitor international, national, and local economic activity for any developments that would change the forecast.