Note: This post is optimized for Desktop viewing.

We recently released our biennial graphic guide to DC’s tax system. It has over 50 graphics illustrating the ins and outs of DC taxes—including property, sales, income taxes, and more. You can read the full guide here or see some snippets of our favorite graphs below. The guide explains…

…The sources of our city revenue

Overview of DC Local Revenue (FY 2023)

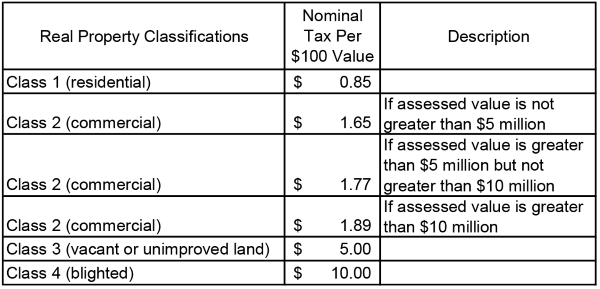

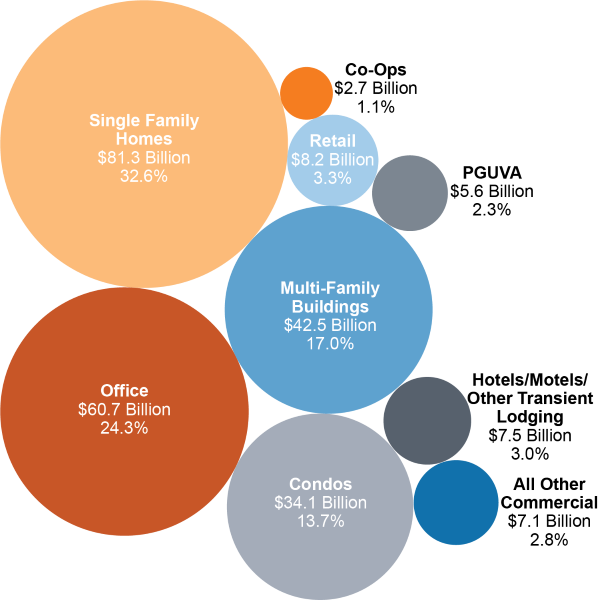

…How different taxes work

Which Properties are Taxable? (January 2024)

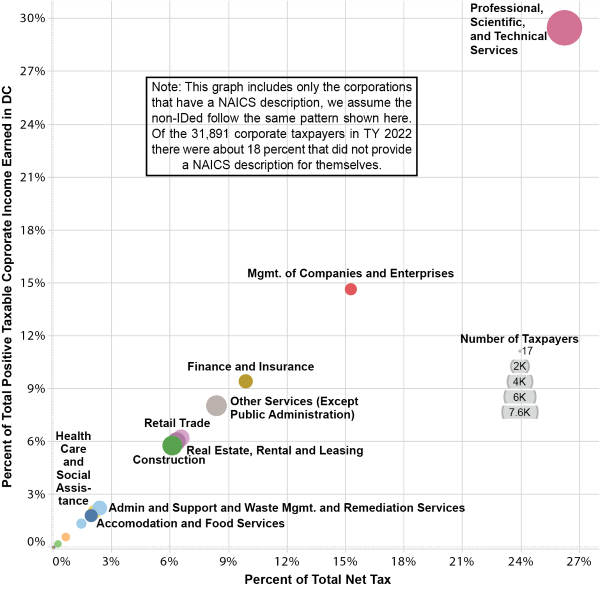

…Who pays what

Individual Income Tax Liability Concentrated Among Earners Over $100k (TY 2022)

Which Industry Pays More Corporate Franchise Tax? (TY 2022)

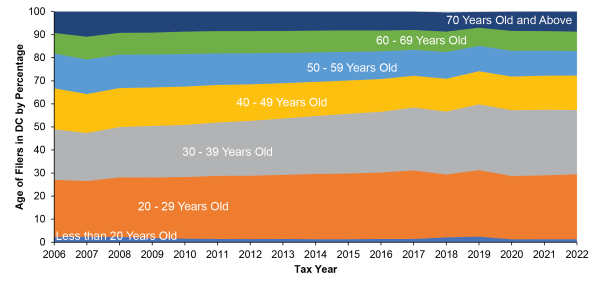

…Who our taxpayers are

Age of Tax Filers in DC from 2006 to 2022

…And how they’re distributed across the city

Tax Revenue Collected from Residential Properties is Concentrated in Central DC (Total $ Amounts by Neighborhood, FY 2024)

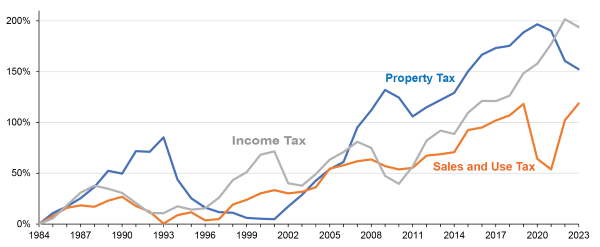

…With important historical context.

Total Percent Change in Tax Collections Since FY 1984 (FY 2017 Dollars)

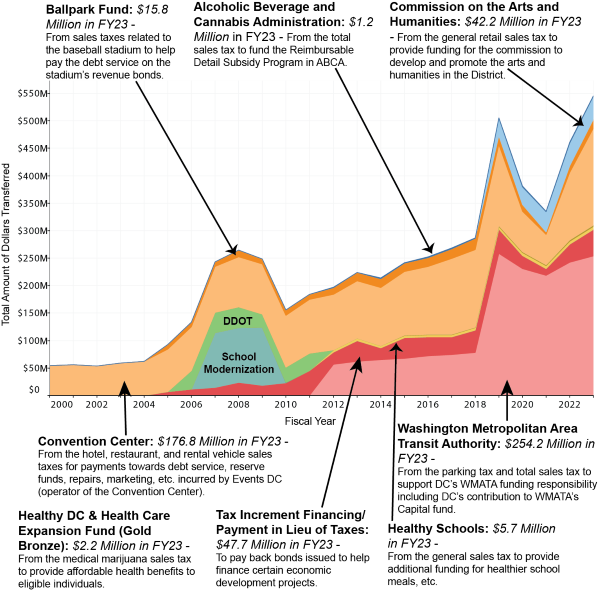

Totals for Dedicated Transfers of Sales Tax Revenue (Revenue Transferred from FY 2000-2023, in Millions)