According to the U.S. Census, 58 percent of the 292,000 occupied housing units in the District of Columbia in 2019 were rental units. Thus, rental housing is the preferred housing type for most in the city and plays an important role in the city's overall housing market. However, rapidly rising costs of even this type of housing (relative to home ownership) is a growing concern for many. In this context, one may suppose the high income of many renters would be positively correlated with their city tenure (i.e. presumably a greater ability to pay). But, this appears not be the case. By way of a closer examination of the role of different rent levels on the city tenure of renters, we find the subsidized monthly rents for respective residents are a significant factor contributing to their relative longer average city tenure, and the very high monthly rents of Class A residents are a significant factor contributing to their shorter average city tenure.

To better understand the role of housing costs in the city’s growth and development, the Office of Revenue Analysis (ORA) conducted a study (see here) to see if different rent levels had any effect on the length of city tenure (i.e. the years in the city) of apartment tenants in the city. This study examined this issue from two perspectives. First, the study assessed the effect of subsidized apartment rents (via Housing Production Trust Fund housing) on respective tenants’ tenure in the city relative to apartment tenants with market rents in comparable Class B and C buildings. And second, the study assessed the effect of relatively high apartment rents (i.e. in large Class A multifamily buildings) on the respective tenant’s tenure in the city relative to apartment tenants with market rents in comparable Class B buildings. Class A buildings are the newest and highest quality buildings built within the last 15 years with top amenities. Class B buildings are generally older buildings and more likely to have lower income tenants. And, Class C buildings are the oldest buildings in the market and tend to be in need of major renovation but have the lowest rental rates.

The Housing Production Trust Fund

The Housing Production Trust Fund (HPTF) is a revenue fund administered by the D.C. Department of Housing and Community Development (DHCD). The HPTF provides gap financing for new and renovated residential projects meant to be affordable for low- to moderate-income households. The goal of the HPTF program is to make sure that “every resident in the District can afford a place to call home.” Since 2001, more than 9,000 affordable housing units have been produced using the Fund’s resources. At the end of fiscal year 2019 the HPTF had an available balance of $142.9 million. [Annually, 15% of deed recordation and transfer revenue from property transactions are dedicated to the Fund. In 2019, that amount was $77.2 million and in 2020, $68.1 million.]

Segmenting the District’s Apartment Rental Market

We compared city tenure of income tax filers who lived in HPTF multifamily buildings for at least one year between 2008 and 2012 to income tax filers who resided solely in market-rate (i.e. non-subsidized rent) Class B or Class C buildings during the same years and in the same neighborhoods. And, in efforts to be more comprehensive in understanding the city’s rental market, we compared city tenures of income tax filers that were residents of large Class A multifamily buildings which have higher rents for at least one year between 2008 and 2012 to income tax filers that were solely residents of market-rate Class B buildings for the same time period also in the same neighborhoods.

The Role of Apartment Rent Levels

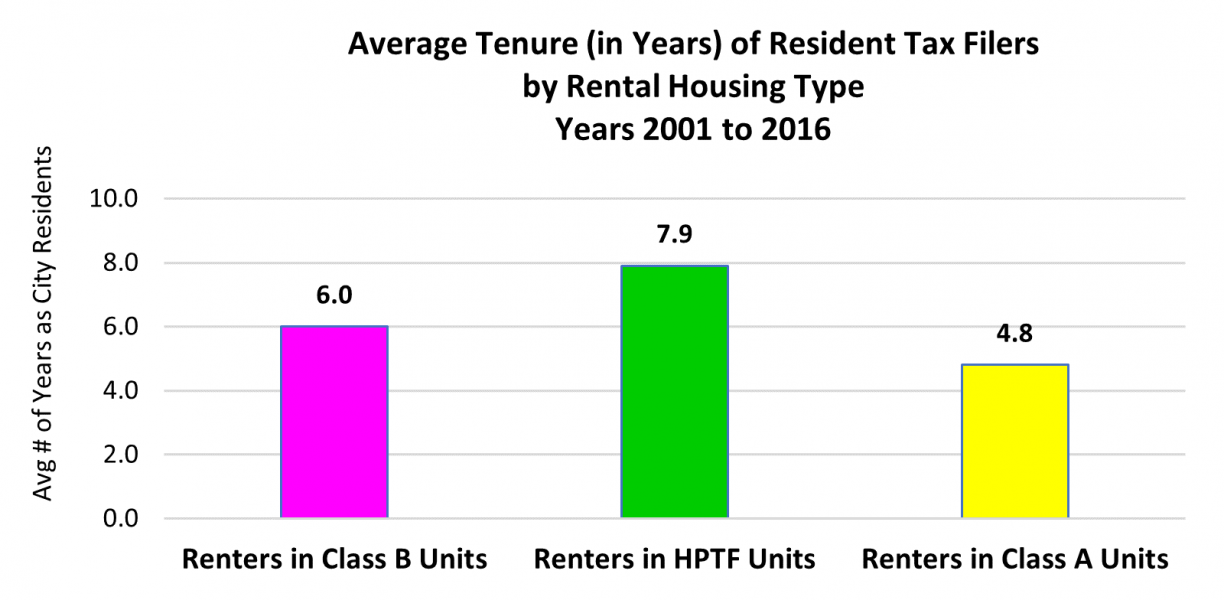

Figure 1 shows that income tax filers who only lived in market rate Class B large multifamily buildings, and controlling for other factors, remained city residents an average of six years. However, income tax filers who lived in an HPTF building tended to remain city residents for almost 2 years longer, and filers who lived in large Class A multifamily buildings tended to remain city residents a little less than 5 years.

Figure 1

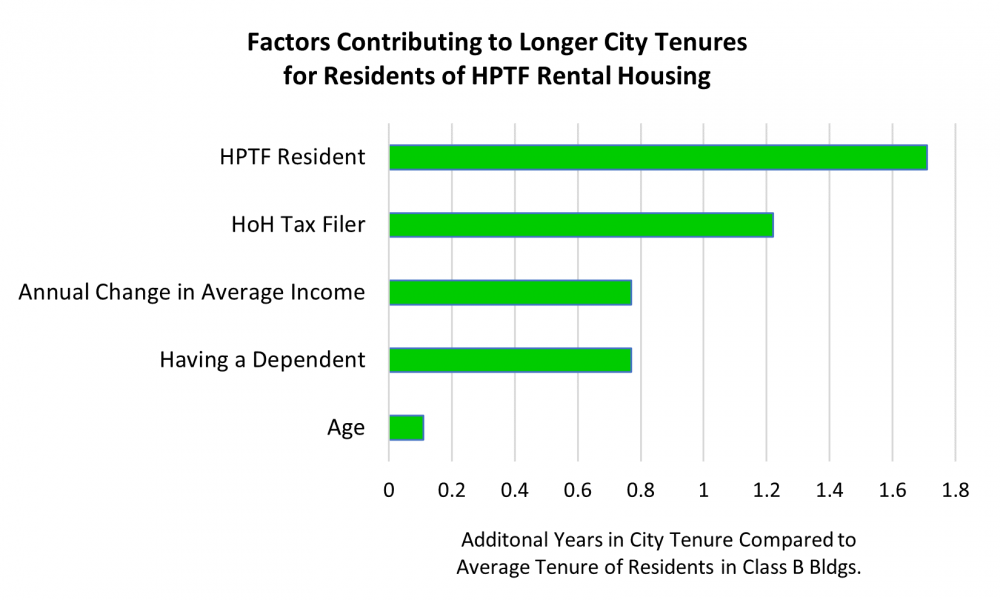

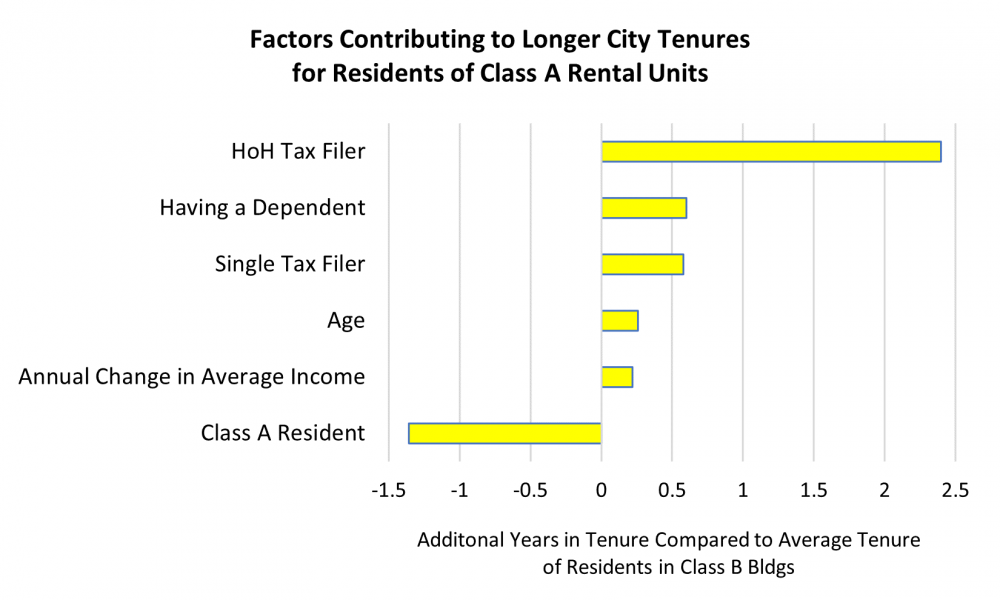

The study found that HPTF residents (relative to market rate Class B rental unit residents) followed by head of household tax filers appear to be the strongest factors identified contributing to longer city tenures as shown in Figure 2. In contrast, Figure 3 shows that for income tax filers who resided in Class A rental units in large multifamily buildings, filing as head of household (relative to filing as married or single) was the strongest factor identified contributing to longer city tenures while residing in a Class A rental unit was also strongly correlated with shorter city tenures. In the models, “being a HPTF resident” is our proxy for having low housing costs (i.e. subsidized monthly rents), “being a Class A resident” is a proxy for enduring some of the city’s highest monthly rents, and “being a Class B resident” is our reference group.

Figure 2

Figure 3

The Role of Income

The study also found that the average income of residents of HPTF rental housing in 2016 was $22,978, while the average income of residents of Class A rental housing was more than 3 times higher at $75,326. However, the effect of average income growth on increasing city tenure was 3.5 times stronger for HPTF residents than Class A residents. This might suggest that, as HPTF residents experience income growth, their subsidized rents may become even more valuable to them when considering the other residential alternatives, including migrating out of the city. Hence, income growth for low income earners appears to be positively correlated with their longer city tenures but has little correlation with longer city tenures by Class A tenants.

Tenants with the Lowest (Highest) Incomes have the Longest (Shortest) Tenures

Because of the city’s high housing costs, one may suppose that high income would be positively correlated with city tenure (i.e. presumably a greater ability to pay). But, the above findings indicate the opposite. We find that the low monthly rents for HPTF residents is a significant factor contributing to their longer average city tenure, and the very high monthly rents of Class A residents are a significant factor contributing to their shorter average city tenure. (While it is probable that at least some outmigrant Class A residents move into homeownership outside the city, such data were not analyzed for this study.) And while there are many factors that influence city tenure, this study focused primarily on the role of rent levels on the city tenure of city residents.

HPTF: Helping to Retain an Economically Diverse City

Since 2006, the District of Columbia has reversed the trend of decline and has experienced significant population growth. However, there continues to be a simultaneous and persistent pattern of out-migration of residents particularly at the lower levels of income. This study finds the level of apartment rents faced by the city renters appears to influence their length of tenure in the city. It also appears that HPTF supported housing is providing an increasing number of affordable housing units to low-to moderate- income residents, which, in turn, is helping to counter the more general pattern of out-migration of low-income residents caused, in part, by the lack of affordable housing and gentrification.

What is this data?

This study utilized administrative tax data that includes District of Columbia individual income tax data for 2001 to 2016, property tax data for 2001 to 2016, and federal individual income tax data for city residents for years 2006 to 2016. The tenure of tenants is based on the cumulative number of years tenants filed their income taxes with the city from their particular residences. Also, HPTF housing data was collected from the DHCD Open Data database and HPTF Annual Reports.

The key model focused on income tax filers that were residents of HPTF multifamily buildings for at least one year between 2008 and 2012 (the treatment group). Accordingly, income tax filers who resided solely in market-rate (i.e. non-subsidized rent) Class B or Class C buildings between 2008 and 2012 are the control group. The use of tenants’ income tax data for years 2001 to 2007 and 2013 to 2016 helped to more accurately identify the start and ending year of city residency and tenure of all tax filers in the study. All tax filers were between the ages of 22 and 70 when they first moved into any of the buildings in the study.