On March 11, the Bureau of Labor Statistics (BLS) published the results of their annual benchmarking of employment statistics. Benchmarking is the process of matching sample-based employment estimates with employment counts from administrative records such as unemployment insurance (UI), Railroad Retirement Board (RRB), and County Business Patterns (CBP). While counts from administrative data are less timely than sample-based estimates, they provide an annual point-in-time census of employment. The benchmark revisions are calculated from the previous year's administrative data so that the results released on March 11 are based on the March 2023 benchmarking. The difference between the universe count of employment for March and its corresponding sample-based estimate represents the benchmark revision. To generate a new employment series, called a "vintage", monthly employment estimates for the months before and after March are revised to align with the March benchmark.

The revisions show District jobs are recovering more slowly post-pandemic than previously estimated. As of December 2023, District employment is at 95% of its pre-pandemic level, instead of the 97% previously estimated by the BLS. The downward revision is driven by a decrease in the estimate of private sector jobs, in particular those in education, non-profit organizations, and professional scientific and technical services.

|

March benchmark revises employment lower for key District sectors Jobs in the District (thousands), March revised (New) v. Previous (Old), December 2023 |

Source: Bureau of Labor Statistics via ALFRED.

The table above compares the revised jobs data with the old data by major sector for the month of December, which was the last month for which the previous jobs data was available before the benchmark revision. The new benchmark has revised the total number of nonfarm jobs in the District for December downward by 13,600. The reduction in jobs was entirely in the private sector, while the number of jobs in the government sector was revised slightly upward by 100. The federal jobs were revised downward by 100, but this was offset by an upward revision in state and local jobs.

The education sector saw the most significant decrease in jobs, with 5,000 fewer jobs in December after benchmark revisions. This was followed by the non-profit sector, an important sector for the District, where the number of jobs was revised lower by 3,300. Additionally, the professional, scientific, and technical services sector had 3,100 fewer jobs. The professional, scientific, and technical services sector, which employs 1 in 6 District workers and includes many high-paying jobs in lobbying and consulting, is the largest private sector category.

As mentioned previously, the BLS uses the March benchmark to update monthly employment estimates before and after March. This process results in the creation of a new series or "vintage" of employment statistics. This allows us to see how the benchmark revisions change our picture of the post-pandemic employment trends for key sectors. Figure 1, below, shows that after the benchmark revisions, the District's post-pandemic labor market performance looks weaker. The December employment data now suggests that we have reached 95% of the pre-pandemic job level, which is slightly lower than the previously reported 97%. The revised data show that private sector employment growth has been slower than previously thought, and the government sector, particularly the federal government, has cut jobs at a faster rate than previously thought. However, the latest data suggests that the federal government has been slowly recovering since the fourth quarter of 2023, which is an improvement from the previously reported declining trend.

Figure 1: Jobs in the District, March Revised v. Previous

Jan 2020 to Jan 2024

Source: Bureau of Labor Statistics via ALFRED

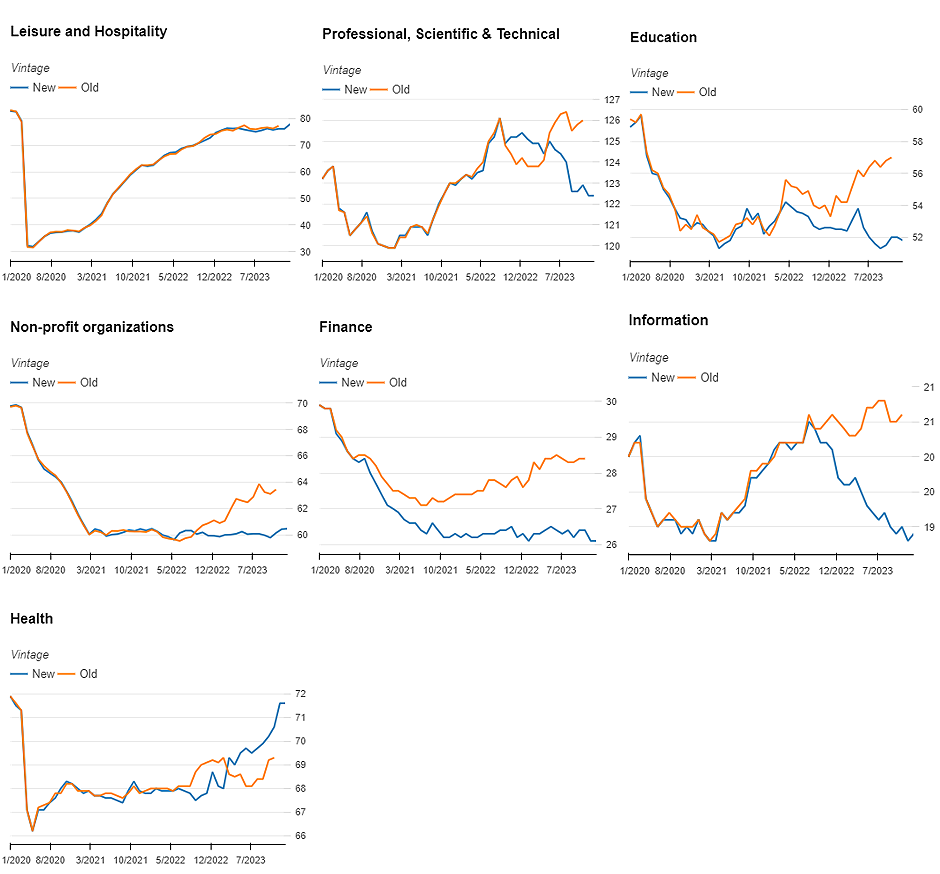

Figure 2, below, shows how the revisions to the benchmark alter the post-pandemic employment trends for some important sectors of the District's economy. The revisions did not have a major impact on the post-pandemic recovery trend for the leisure and hospitality sector, which experienced the most significant job losses during the pandemic, but has been steadily recovering since. However, the updated data indicates that employment growth, after a brief recovery immediately following the pandemic, has been sluggish or decreasing for some crucial service sectors, including the education, professional/scientific/technical, non-profit, finance, and information sectors. The previous data indicated an ongoing slow recovery for these sectors. Conversely, the revised data indicates employment growth in the healthcare sector since 2022, whereas the previous data showed that growth had been stagnant.

Figure 2: Jobs in the District, March Revised v. Previous - Key Sectors

Jan 2020 – Jan 2024

Source: Bureau of Labor Statistics via ALFRED.

The benchmark revision has resulted in a reduction of the total number of jobs in the District by 1.7 percent, which is not too large in relative terms. However, reductions were relatively significant for some key sectors in the District such as education (8.8 percent), information (7.6 percent), finance (7.0 percent), and non-profit organizations (5.5 percent). These benchmark revisions paint a more pessimistic picture of the post-pandemic trends for these sectors, which were major employment providers before the pandemic. It is worth noting that benchmark revisions vary significantly each year, and next year's revision could change our understanding of the District job market once again. However, for this year, the revised data suggests that the job market is weaker than we previously believed.

What is this data?

This analysis is based on employment statistics from the Bureau of Labor Statistics (BLS), which were retrieved from the Federal Reserve Bank of St. Louis ALFRED® system. This system maintains archives of economic data for thousands of economic series and allows users to retrieve vintage versions of economic data that were available on specific dates in history. It is important to note that previous versions of economic data can be superseded and may no longer be available from various data sources, as economic data for past observation periods are revised as more accurate estimates become available. With ALFRED®, we can easily retrieve and compare different economic data vintages, just like we did in this analysis. This access to past data vintages is essential for researchers to replicate and validate others' work, create more precise forecasting models, and analyze past economic decisions using the data that was available at that time. ALFRED® thus plays a crucial role in enhancing the quality and accuracy of economic research.