Wednesday, November 1, 2023 - 12:45pm

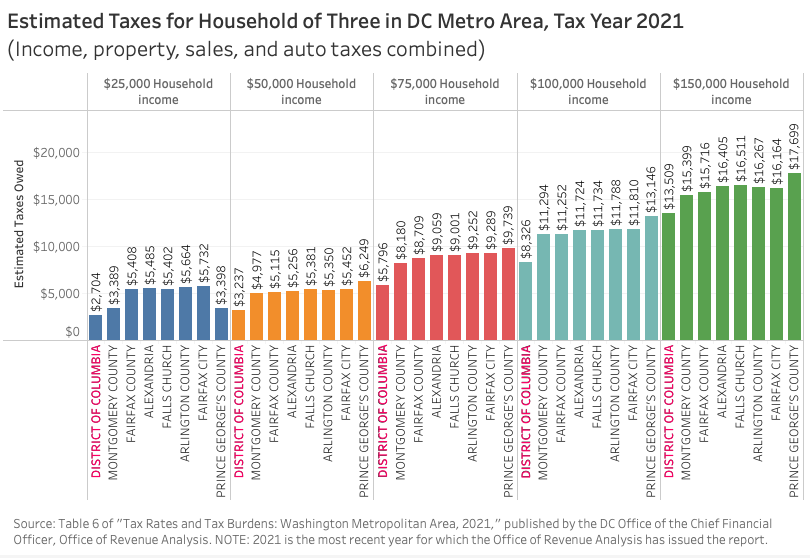

Each year, the Office of Revenue Analysis publishes a pair of tax burden studies, which compare the amount of taxes a hypothetical family of three would pay in DC to the taxes they would pay in surrounding jurisdictions and the largest city in each of the 50 states. Our analysis calculates the combined amount of income, property, auto, and sales taxes the family would pay at household incomes of $25,000, $50,000, $75,000, $100,000, and $150,000. The hypothetical family includes two married earners and one child. Our studies for tax year 2021, released earlier this year, found:

- DC households of three earning up to $150k pay less in taxes than they would in neighboring jurisdictions. A hypothetical family of three would pay less in taxes in DC than in surrounding jurisdictions when income, property, sales, and auto taxes for tax year 2021 are combined – see graphic below.

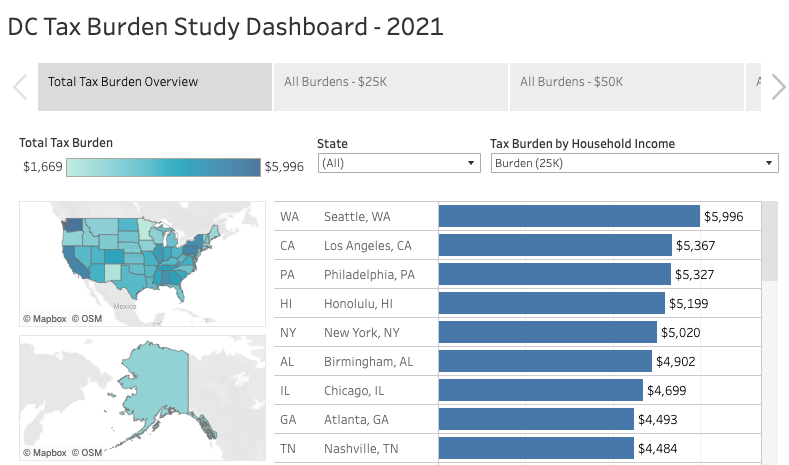

- A DC household of three making up to $150k would pay less in taxes than the average of taxes they’d pay in the largest city of each of the 50 states. For further perspective, the amount of taxes paid by the hypothetical family of three in DC would be lower than 40 of the 50 cities studied at an income of $25k; lower than 44 of the cities at $50k; lower than 41 of the cities at $75k; lower than 36 of the cities at $100k; and lower than 30 of the cities at $150k household income. To calculate the family’s tax payment, we combine income, property, sales, and auto taxes for tax year 2021.

- We’ve created an interactive, online tool so you can compare the taxes paid by the family of three in DC to the taxes they would pay in other cities across the country. In addition to comparing total taxes paid, you can also separately look at income, property, auto, and sales tax.

- Our tax burden studies also compare DC tax rates to those across the country, including everything from beer and wine taxes, to deed recordation taxes, to individual and corporate income taxes.